Login

Login

Sign Up

Forgot Password?

Bankrupt Philadelphia Refinery sold in auction to Chicago developer Hilco’s for $240 million

- Jan 23, 2020

Bankrupt Philadelphia Energy Solutions has agreed to sell its shuttered South Philly refinery complex to a Chicago development company with experience repurposing old industrial properties for new uses, likely marking an end to the site’s 150-year-old history as a petroleum refinery.

Hilco Redevelopment Partners, a Chicago real estate firm that has acquired old power plant sites in Boston and New Jersey, and is building warehouses on a former steel mill site in Baltimore, agreed to pay $240 million to acquire the 1,300-acre refinery site during a closed-door auction Friday, according to a U.S. Bankruptcy Court filing.

PES chief executive Mark Smith announced the deal Tuesday in a memo to employees, saying that Hilco’s affiliate, HRP Philadelphia Holdings LLC, would announce its plans for the site at a later date.

“We will continue to maintain the refinery complex, remove the hydrocarbon inventory in the facility, protect the facility and prepare for a safe handoff of the facility to HRP Philadelphia Holdings LLC, which is expected to occur within 60-90 days,” Smith said in his memo.

Hilco’s selection means that Philadelphia’s largest available commercial real estate parcel may emerge from bankruptcy with a less intensive industrial capacity, a goal of environmental and community activists who have rallied against the oil refinery. After more than a century of refining, the site will also need environmental remediation. But it’s not immediately clear when that will happen, and who will pay the bill.

Hilco officials could not be reached Tuesday afternoon. The Inquirer reported Friday that Hilco was a finalist.

PES filed a formal notice of the agreement with U.S. Bankruptcy Court in Wilmington, where the company filed for bankruptcy protection last July after a devastating fire June 21 closed the refinery. The sales agreement needs to be confirmed by the court at a scheduled Feb. 6 hearing.

Hilco’s precise plans could not be determined, and it’s possible it could lease some part of the site to operate as a fuel-production facility. The fire left one of the two refineries in the complex undamaged.

PES, the East Coast’s largest refinery, employed 1,100 people before its closure. The Steelworkers Union contended that the refinery was capable of producing fuel but that the out-of-town investors who owned it cut their losses after the fire and shut it down, hoping to recover some of the plant’s $1.25 billion in insurance coverage. An insurance settlement is unresolved.

Environmentalists and community activists had pushed for a permanent closure of the refinery, which was the city’s largest stationary source of air pollution, and for area residents the catastrophic explosion in June was a dramatic reminder of the risks posed by the fuel-refining complex.

With the approval of the bankruptcy court, representatives of Philadelphia city government were present during Friday’s auction in New York and consulted with the bidders.

“We welcome the selection of Hilco Redevelopment Partners as the winning bidder for the refinery site," Mayor Kenney said in a statement Wednesday. “Though many challenges and years of work lie ahead, we are optimistic that the firm can develop this site in way that supports the core values in the city’s recent report summarizing the work of the Refinery Advisory Group: a diverse range of uses on the site that put the public’s safety as a top priority, has a more positive impact on the environment, engages meaningfully with the surrounding communities, and contributes significantly to the region’s economy.”

In the end, it was probably market forces that doomed any efforts to restart the plant, including a proposal by the refinery’s former chief executive, Philip Rinaldi. According to sources, Rinaldi’s group, Philadelphia Energy Industries, was unable to obtain sufficient financing to restart the refinery in a market that seems to be oversupplied with refineries, and faces a long-term decline in the use of fossil fuels.

Latest News

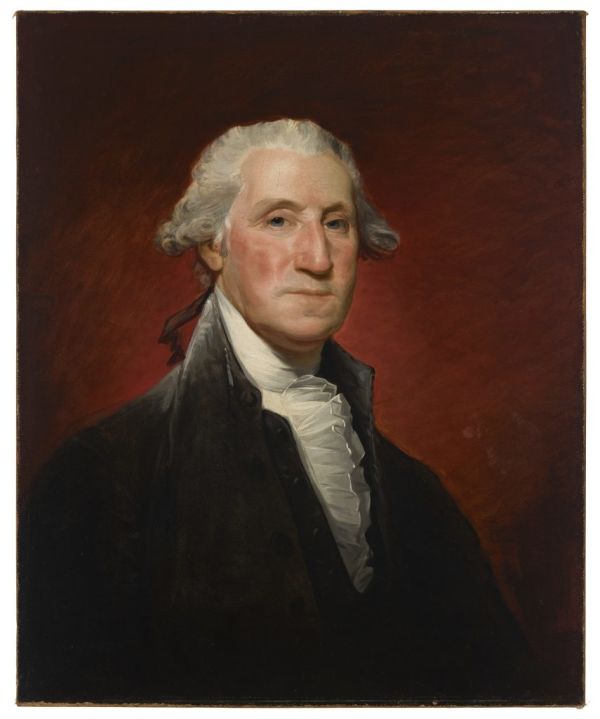

The Met Is Selling a George Washington Portrait to Fund Its New Acquisitions

By Adam Schradee

Evolution of American Coinage: From Liberty Heads to Saint-Gaudens Double Eagles

By Liz Catalano

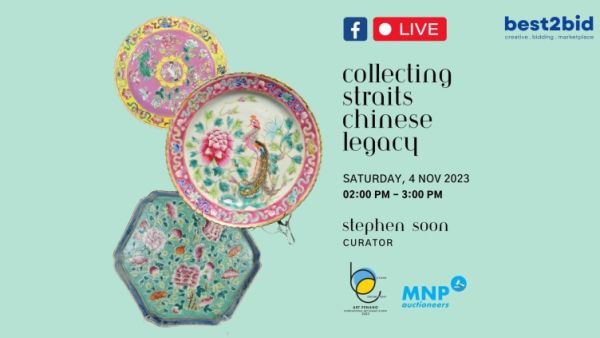

Become An Expert In 2 Minutes: Exploring the Special Straits Chinese Collection

By Andy Penders